Generation Mining Announces Expanded Mineral Resource at Marathon Deposit, Increased To 7.13 Million Oz Palladium Equivalent

Toronto, Ontario – Sept 9, 2019 – Generation Mining Limited (CSE:GENM) (“Gen Mining” or the “Company”) is pleased to report that a new independent Mineral Resource Estimate of the Marathon Deposit of the 51%-owned Marathon palladium-copper project in Northern Ontario estimates a 20% increase in contained Palladium-Equivalent ounces compared with the most recently published Mineral Resource on the Property from 2010. Highlights of the pit constrained Mineral Resource Estimate are as follows:

- Contains a Measured and Indicated Mineral Resource of 7.13 million oz palladium equivalent (PdEq), within a 179 million tonne pit constrained deposit grading 1.24 grams per tonne PdEq, calculated at a $C13 NSR per tonne cut-off (includes an estimated 3.24 million oz Pd, 1.06 million oz Pt and 796 million lbs of Cu).

- Using a $25 NSR per tonne cut-off Mineral Resource Estimate sensitivity, contains a Measured and Indicated Resource of 5.83 million ounces PdEq within a 116 million tonne pit constrained deposit grading 1.56 grams per tonne PdEq (includes an estimated 2.73 million oz Pd, 0.85 million oz Pt and 639 million lbs of Cu).

The Mineral Resource Estimate was prepared by P&E Mining Consultants Inc. of Brampton, Ontario, and was prepared using drill-hole data generated from past operators between 1985 and 2014. In doing so, P&E created an updated block model from scratch reflecting the recent improvements in some metal prices.

The Marathon Property was explored by various companies over the past 35 years, and during this time, more than 1,094 drill holes totalling 203,000 metres were completed. The majority of this drilling was into the Marathon Deposit.

“We are pleased to confirm and substantially improve on the historical Mineral Resource Estimates done on this project by previous operators and based on these results we plan to begin a Preliminary Economic Assessment (PEA) immediately,” comments Generation CEO Jamie Levy.

Pit Constrained Mineral Resource Estimate at C$13/tonne NSR Cut-Off (1-7)

| Classification |

Tonnes (k) |

Pd (g/t) |

Pt (g/t) |

Cu (%) |

Au (g/t) |

Ag (g/t) |

PdEq (g/t) |

Pd (koz) |

Pt (koz) |

Cu (Mlb) |

Au (koz) |

Ag (koz) |

PdEq (koz) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Measured |

103,337 |

0.64 |

0.21 |

0.20 |

0.07 |

1.5 |

1.34 |

2,123 |

688 |

463 |

239 |

4,964 |

4,445 |

|

Indicated |

75,911 |

0.46 |

0.15 |

0.20 |

0.06 |

1.8 |

1.10 |

1,115 |

376 |

333 |

151 |

4,371 |

2,685 |

|

Meas & Ind |

179,248 |

0.56 |

0.18 |

0.20 |

0.07 |

1.6 |

1.24 |

3,238 |

1,064 |

796 |

390 |

9,335 |

7,130 |

|

Inferred |

668 |

0.37 |

0.12 |

0.19 |

0.05 |

1.4 |

0.95 |

8 |

3 |

3 |

1 |

31 |

21 |

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

- The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

- The Mineral Resources in this report were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

- The Mineral Resource Estimate was based on US$ metal prices of $1,100/oz Pd, $900/oz Pt, $3/lb Cu, $1,300/oz Au and $16/oz Ag. The US$:CDN$ exchange rate used was 0.77.

- The NSR estimates use flotation recoveries of 93% for Cu, 82% for Pd, 80% for Pt, 80% for Au, 75% for Ag and smelter payables of 96% for Cu, 93% for Pd, 88% for Pt, 90% for Au, 90% for Ag .

- The pit optimization used a mining cost of C$2 per tonne, combined processing, G&A and off-site concentrate costs of C$13/tonne and pit slopes of 50o.

Pit Constrained Mineral Resource Estimate Sensitivity at C$25/tonne NSR Cut-Off

| Classification |

Tonnes (k) |

Pd (g/t) |

Pt (g/t) |

Cu (%) |

Au (g/t) |

Ag (g/t) |

PdEq (g/t) |

Pd (koz) |

Pt (koz) |

Cu (Mlb) |

Au (koz) |

Ag (koz) |

PdEq (koz) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Measured |

70,792 |

0.82 |

0.25 |

0.25 |

0.09 |

1.5 |

1.67 |

1,864 |

578 |

387 |

194 |

3,510 |

3,794 |

|

Indicated |

45,279 |

0.60 |

0.19 |

0.25 |

0.07 |

1.9 |

1.40 |

871 |

272 |

252 |

106 |

2,817 |

2,032 |

|

Meas & Ind |

116,071 |

0.73 |

0.23 |

0.25 |

0.08 |

1.7 |

1.56 |

2,735 |

850 |

639 |

300 |

6,326 |

5,826 |

|

Inferred |

144 |

0.62 |

0.16 |

0.28 |

0.05 |

0.9 |

1.41 |

3 |

1 |

1 |

0 |

4 |

7 |

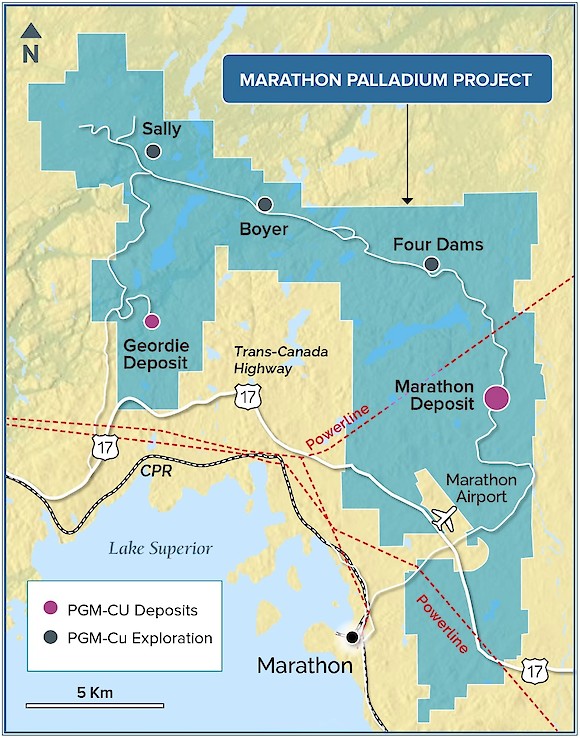

The Updated Mineral Resource Estimate does not include the previously published historic Mineral Resource Estimate at the Geordie Deposit. P&E have been engaged to prepare an updated estimation of the Geordie Mineral Resource, as well as estimate an Initial Mineral Resource at the Sally Deposit which was drilled off by a previous project operator. Both Geordie and Sally are located on the Marathon Property and are considerably smaller and somewhat lower grade than the Marathon Deposit. Once the results of these two estimates are received, Gen Mining will decide whether to include these deposits in the PEA.

Exploration Update

Further to the Company’s August 19th, 2019 news release and at the time of writing Drill #1 has completed a confirmation-infill drill program of 5 holes over a portion of the Marathon Deposit. Drill #1 is currently drilling on the West Feeder Zone target. Drill #2 is working on testing targets in the Geordie Deposit area. Three out of eight planned holes have been completed at Geordie. In all, approximately 2,900 metres, out of a planned 12,000 metres, have been drilled to date. All assays are pending.

Gen Mining’s Marathon project is located less than 10 km from the town of Marathon, Ontario, and is very close to the Trans-Canada highway and the CPR main line. The new 230 kilovolt East-West Tie powerline from Wawa to Thunder Bay which is expected to begin construction shortly, will pass through part of the Marathon Property.

Gen Mining acquired a 51% interest in the property from Sibanye Stillwater on July 10, 2019, and can increase its interest to 80% by spending $10 million over a period of four years. Sibanye has certain back-in rights that can bring its interest in the project back to 51% (see the Company’s press release of July 11, 2019 for more details).

Qualified Persons

Rod Thomas, P.Geo., Company Vice-President, Exploration, and a Director and Eugene Puritch, P.Eng. FEC, CET of P&E Mining Consultants Inc. have reviewed and approved the scientific and technical information contained in this news release. Messrs. Thomas and Puritch are Qualified Persons for the purposes of National Instrument 43-101 Standards of Disclosure for Mineral Projects.

About Generation Mining Limited

Generation Mining Limited is a precious and base metal exploration and development company with various property interests throughout Canada. Its primary business objective is to explore and further develop these properties, and to continue to increase its portfolio of base and precious metal property assets through acquisition. The Company’s common shares trade on the Canadian Securities Exchange (“CSE”) under the symbol GENM.

For further information please contact:

Jamie Levy

President and Chief Executive

Officer

(416) 640-2934

(416) 567-2440

[email protected]

Forward-Looking Information

This news release includes certain information that may be deemed “forward-looking information” under applicable securities laws. All statements in this release, other than statements of historical facts, that address acquisition of the Property and future work thereon, Mineral Resource and Reserve potential, exploration activities and events or developments that the Company expects is forward-looking information. Although the Company believes the expectations expressed in such statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the statements. There are certain factors that could cause actual results to differ materially from those in the forward-looking information. These include the results of the Company’s due diligence investigations, market prices, exploration successes, continued availability of capital and financing, and general economic, market or business conditions.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking information. For more information on the Company, investors are encouraged to review the Company’s public filings at www.sedar.com. The Company disclaims any intention or obligation to update or revise any forward- looking information, whether as a result of new information, future events or otherwise, other than as required by law.