Generation Mining Defines New Palladium Mineralization West Of The Marathon Deposit

Toronto, Ontario – October 29, 2020 – Generation Mining Limited (TSX:GENM) (OTCQB: GENMF) (“Gen Mining” or the “Company”) is pleased to announce initial results from its exploration drilling program focused on the down-dip western extension of the W Horizon portion of the Marathon Palladium Deposit which is currently the subject of a Feasibility Study. The W Horizon contains approximately 14%, by volume, of the mineralization in the Marathon Palladium Deposit.

The drill program, designed to test the potential for near surface, ramp accessible mineralization, commenced August 24th, 2020 and was completed on October 24th, 2020. Twelve holes were drilled for total of 5,068 meters.

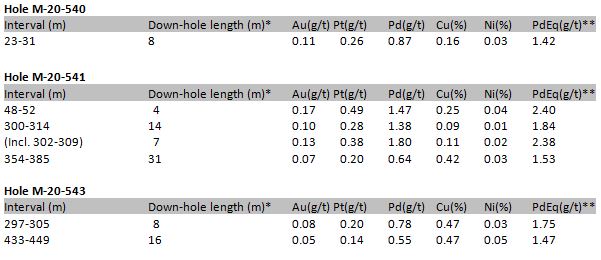

Holes M-20-540 – M-20-543 inclusive, intersected mineralized intervals down dip from the Marathon Palladium Deposit and south of the 4,900 N Fault. Assay results for hole M-20-542 are pending. Assay results for holes M-20-540, M-20-541 and hole M-20-543 have been received and significant down hole intervals are compiled in Table 1 below:

Table 1 – Significant Assay Results Holes M-20-540, M-20-541 and M-20-543

Table 1 – Footnotes

* True width approximates Down-hole length (m)

** The Palladium Equivalent (“PdEq”) calculation expressed in g/t is the sum of the theoretical in situ value of the constituent metals (Au + Pt + Pd + Cu) divided by the value of one gram of palladium. The calculation makes no provision for expected metal recoveries or smelter payables. USD per ounce commodity prices of $1,300, $900, $1275 were used, respectively, for Au, Pt and Pd and a $3/lb value was assigned for Cu. Ni values were not used to calculate PdEq.

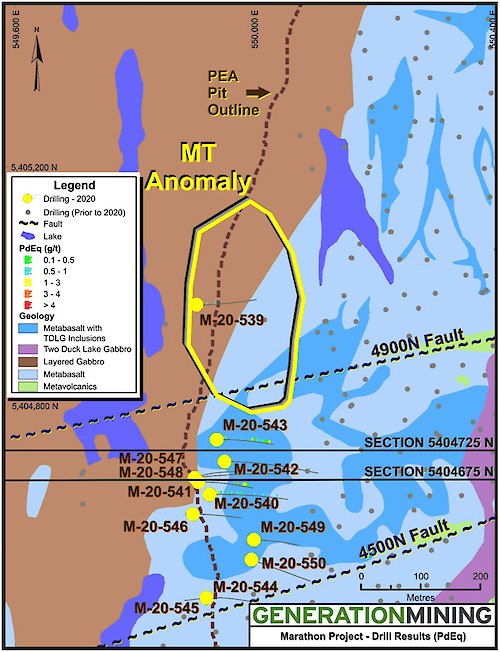

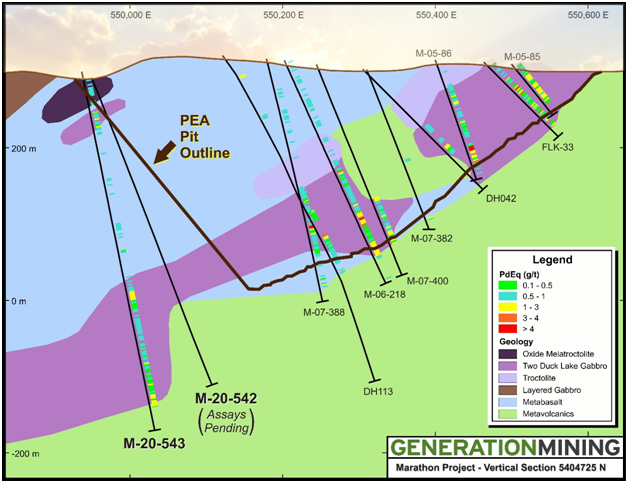

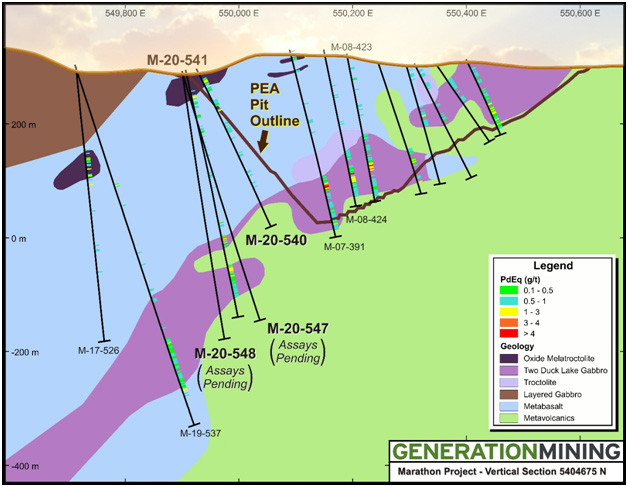

Drill hole locations and sections are shown on the attached figures:

Figure 1: Marathon Project - Drill Location Map

Figure 2: Marathon Project – Vertical Section 5404725 N

Figure 3: Marathon Project – Vertical section 5404675 N

The 8-metre and 4-metre intervals in holes M-20-540 and M-20-541, respectively, corresponds to a unit of oxide melatroctolite (a magnetite bearing olivine rich rock) south of the 4,900 N Fault. Oxide melatroctolite makes up about 2%, by volume, of the mineralization estimated in the (Amended) Technical Report, Updated Mineral Resource Estimate and Preliminary Economic Assessment of the Marathon Deposit by P&E Mining Consultants Inc. (filed on SEDAR July 7, 2020).

The 14-metre interval intersected in hole M 20-541 corresponds to W Horizon mineralization. The down dip continuation of the W Horizon in this area is considered very encouraging. The W Horizon is recognized in the scientific literature as a zone of extreme Pd enrichment and consequently there is potential in this area for Pd grades similar to those intersected up dip in holes M-08-423 (2.2 g/t Pd over 12 m), M-07-391 ( 3.3 g/t Pd over 10 m) and M-08-424 (3.3 g/t Pd over 2 m) previously drilled in 2006 – 2008. Additionally, the 31 metre continuously mineralized interval in hole M-20-541 corresponds to typical Main Zone mineralization, wider than previously encountered in the area south of the 4,900 N Fault.

The 16-metre interval intersected in hole M-20-543 corresponds to an interval of net textured to massive sulphides situated (See Figure 4) at the base of the Marathon Series rocks which host the Marathon Palladium deposit. These cumulate-style sulphide accumulations in hole M-20-543 are the thickest drilled to date and representative of sulphide accumulations that could form at the base of the feeder zone to the Marathon deposit. Crone Geophysics has completed a down hole Pulse EM survey of this hole to search for additional, potential sulphide bodies in the immediate area. Results are being processed.

Figure 4: Marathon Project – Photograph of massive sulphides from Hole M-20-543 interval 433-449 m

Jamie Levy, President and CEO of Gen Mining states: “We are very excited that the exploration drilling program has intersected intervals of palladium mineralization immediately west of the known Marathon deposit and to have also identified a 16 m thick horizon of net textured to massive sulphide mineralization at the base of the Marathon Series rocks. Although this drilling is external to the known resource, and will have no impact on the ongoing Feasibility Study, it is encouraging to see that going forward, there is the potential to define additional resources in the immediately vicinity of the Marathon deposit.”

Hole M-20-539 which was the first hole of the 2020 program tested a magnetotelluric (“MT”) anomaly situated immediately west of and down dip from the Marathon deposit (see Gen Mining press release of August 6th, 2020). Target depth was estimated at 650 metres; however, the drill unexpectedly intersected the footwall (Archean basement) at 333.4 metres which is quite shallow in this area. Subsequent down hole Crone pulse EM survey of hole M-20-539 yielded an off-hole anomaly to the east situated immediately beneath hole M-07-396 (drilled in 2007) which had been drilled into the footwall and was terminated in Archean aged, barren, massive pyrrhotite unrelated to the mineralizing event which formed the Marathon Deposit. No further follow up work of the MT target in this specific area is contemplated at this time.

Assay results for the remaining 8 holes are pending.

The Company is well financed for the next phases of work, including the feasibility study and the restart of the permitting process, both of which are underway at the Marathon Palladium Copper Project, with approximately $10.2 million in cash.

Quality Assurance/Quality Control

Quality assurance and quality control (“QA/QC”) protocols for the 2020 drilling assay program were unchanged from previous years and involve a rotating inclusion of one duplicate, blank, low-grade standard and high-grade standard every 15 samples. All controls are checked to be within a working limit of 2 standard deviations. Sample intervals are selected in 1 m or 2 m lengths dependent on the nature of the mineralized zone. The core samples are split on site using a diamond saw where half of the core is sent for analysis and the other half is securely stored on site for future reference. All samples are shipped to ALS in Thunder Bay for processing.

About the Marathon Palladium Project

Generation Mining has begun a Feasibility Study on the Marathon Deposit, which is the largest undeveloped platinum group metal Mineral Resource in North America. The Marathon Property covers a land package of approximately 22,000 hectares or 220 square kilometres. Gen Mining acquired a 51% interest in the Marathon Property from Sibanye Stillwater on July 10th, 2019 and can increase its interest to 80% by spending $10 million over a period of four years. As of the end of Q3 2020, approximately $8.7 million of the $10 million has been spent. Sibanye Stillwater has certain back-in rights that allow it to increase its interest in the Marathon Project back up to 51% in certain circumstances and subject to certain conditions after such time as Gen Mining has earned its 80% interest (see the Company’s press release of July 11, 2019 for more details).

Qualified Person

Rod Thomas, P.Geo., Company Vice-President, Exploration and a Director has reviewed and approved the scientific and technical information contained in this news release. Mr. Thomas is a Qualified Person for the purposes of National Instrument 43-101 Standards of Disclosure for Mineral Projects.

For further information please contact:

Jamie Levy

President and Chief Executive

Officer

(416) 640-2934

(416) 567-2440

[email protected]

Forward-Looking Information

This news release includes certain information that may be deemed “forward-looking information” under applicable securities laws. All statements in this release, other than statements of historical facts, that address acquisition of the Property and future work thereon, Mineral Resource and Reserve potential, exploration activities and events or developments that the Company expects is forward-looking information. Although the Company believes the expectations expressed in such statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the statements. There are certain factors that could cause actual results to differ materially from those in the forward-looking information. These include the results of the Company’s due diligence investigations, market prices, exploration successes, continued availability of capital and financing, and general economic, market or business conditions.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking information. For more information on the Company, investors are encouraged to review the Company’s public filings at www.sedar.com. The Company disclaims any intention or obligation to update or revise any forward- looking information, whether as a result of new information, future events or otherwise, other than as required by law.